The Latest from Marthe

-

Bringing stablebonds to DeFi: why we invested in etherfuse

Bonds are the basis for all financial products of the modern world, etherfuse is bringing them to DeFi.

-

Enabling frictionless crypto spending: why we invested in Kulipa

After a year of working closely with the team, we’re excited to publish more detail on why we co-led Kulipa's seed roud alongside Fabric Ventures.

-

Ensuring trust in the trustless: why we invested in Lockchain.ai

Lockchain.ai is the world’s first AI-powered risk management platform for blockchain, integrating analytics, monitoring, and automated response.

-

Our investment in Ether.fi, the leading liquid restaking protocol

With over $2.7bn in Eth of TVL, ether.fi has the largest adoption rate and TVL growth of any liquid staking token. Read more about why we invested.

-

Ethereum liquid restaking protocol Ether.fi closes $27 million Series A

Ether.fi, the largest liquid restaking protocol, has closed a $27 million Series A.

-

On AI, the GPU shortage, and the potential of decentralised inference and training networks

Can the challenges of securing, coordinating, and verifying disparate compute supply make this a winner-takes-all market?

-

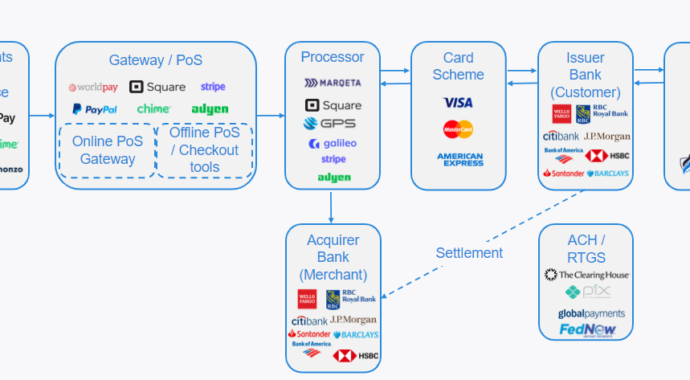

Lessons from Fiat: The crypto payments industry and the race to volume

Paying in cryptocurrency is neither cheap nor efficient and companies building in the payments industry face a bind. Read more on how we solve it.

-

Building the next generation Digital Asset Lender: why we invested in Trident’s $8m Seed Round

As they emerge from stealth, we’re excited to announce our investment in Trident’s $8m Seed Round, co-led with New Form Capital.

-

Reinventing the data economy: why we invested in Oamo

We’re thrilled to announce our $1.25m pre-seed investment in Oamo, a decentralised data broker. Here's why we invested.

-

Oamo emerges from stealth with White Star Capital backing to build decentralised data brokerage

The Web3 startup has secured $1.25m in pre-seed financing solely from White Star Capital to build out its team and product.