Our Latest Thoughts

-

‘Resilience is crucial’: Valérie Grenier on what it takes to race at the top

With excitement building for the new 2023/24 season, we sat down with one of Canada’s premier Alpine Ski racers, Valérie Grenier.

-

Fund IV investment themes: The Fourth Industrial Revolution

We’re excited to share the second of our Fund IV investment themes on the digitisation of all industries and enterprises.

-

Fund IV investment themes: The Sustainable Global Economy

Our latest report on the Sustainable Global Economy, a macro theme we believe will drive tech innovation in the coming years.

-

Advancing healthcare with blockchain: why we invested in Rymedi

With comprehensive solutions, a blockchain foundation, and a dedicated team, Rymedi has the potential to revolutionise healthcare infrastructure.

-

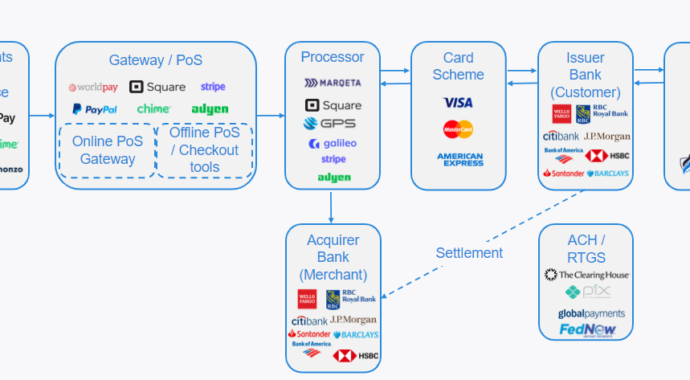

Lessons from Fiat: The crypto payments industry and the race to volume

Paying in cryptocurrency is neither cheap nor efficient and companies building in the payments industry face a bind. Read more on how we solve it.

-

Introducing our Fund IV investment themes

Looking ahead to our fourth Early Growth Fund, we have identified four specific macro themes that we believe are primed for continued tech innovation.

-

White Star Capital’s 2023 ESG Report

White Star Capital's latest ESG report that highlights our portfolio, procedures, and people that are enabling the firm to deliver positive change.

-

Open Banking: Applying lessons from the UK & US for the future of fintech in Canada

Open banking is a game changer. Having already taken place in the UK, we think that it has huge potential in Canada.

-

Building the next generation Digital Asset Lender: why we invested in Trident’s $8m Seed Round

As they emerge from stealth, we’re excited to announce our investment in Trident’s $8m Seed Round, co-led with New Form Capital.