Our Latest Thoughts

-

High-quality education for all: why we invested in MyEdSpace

We are thrilled to lead MyEdSpace’s $15m Series A alongside Educapital, Coalition Capital, and Active Partners.

-

White Star Capital launches North American Seed Fund

We're excited to launch our dedicated North American Seed Fund, with a first close of $25m and a target size of $50m.

-

White Star Capital promotes Sanjay Zimmermann to General Partner

We’re delighted to announce Sanjay Zimmermann's promotion to General Partner.

-

Rewarding healthy habits: why we invested in Elfie

Elfie is building a global digital health super-app to support people living with chronic conditions stay on track with their treatments.

-

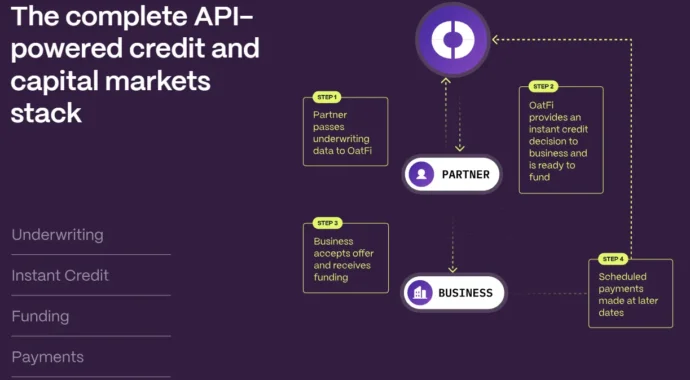

Building the modern credit network for B2B payments: why we invested in OatFi

With OatFi, SMBs can access instant credit for working capital, no longer subjecting them to cash flow challenges from payment term mismatches.

-

Transforming retail security with gesture-based AI: why we invested in Veesion

Veesion’s AI-powered gesture recognition technology transforms retail security by enabling real-time shoplifting detection.

-

Lighting the dark web: why we invested in Flare

White Star Capital is proud to continue backing Flare as the company raises a $30m Series B led by Base10.

-

Vertical AI: how industry-specific intelligence is transforming the business landscape

Horizontal AI tools have been widely adopted, will we see the same market penetration as Vertical AI tools come to market?

-

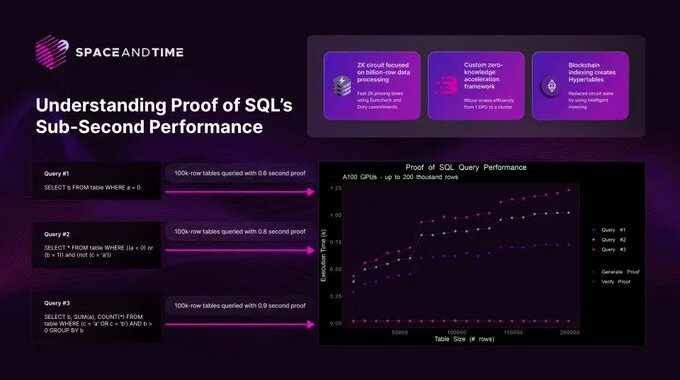

Making smart contracts smarter: why we invested in Space and Time

The first decentralised data warehouse that delivers ZK proofs against onchain and offchain data to power the future of AI and blockchain.